Benefits of Hiring Accountants for Small Business

If you’re running a small business, you’re already juggling a million tasks at once. Handling customer service, managing employees, growing your brand and yes, dealing with finances. That last part can be tricky. This is where accountants for small businesses make a world of difference.

At One Accounting, we specialize in supporting small business owners like you across Toronto and beyond. We bring not only technical expertise in tax, bookkeeping, and compliance but also real-world business insight that helps you thrive in a competitive environment.

1. Get Expert Financial Guidance from Day One

Starting or scaling a business often means navigating a maze of financial decisions from registering your business to securing funding and managing early cash flow. An accountant doesn’t just show up during tax season, they’re a strategic advisor from the outset.

Professional accountants for small business offer:

- In-depth knowledge of tax regulations and compliance – so you don’t fall into traps that can lead to fines or audits.

- Forward-looking financial planning and forecasting – ensuring your growth is sustainable and backed by realistic projections.

- Precise budgeting and reporting techniques – giving you a clear view of your operational costs and profitability.

With their experience in supporting businesses like yours, they offer actionable insights that help you avoid financial missteps and focus your efforts on what matters most growth.

Now that your financial roadmap is in place, it’s time to look at the practical advantages of working with a pro.

2. Save Time and Reduce Stress

Time is your most valuable resource, especially when you’re wearing multiple hats. Bookkeeping, payroll, and tax filing are not only time-consuming, they’re mentally taxing and prone to error if rushed.

An accountant helps you to get the following done efficiently and accurately:

- Automate and categorize transactions efficiently

- Track your income, expenses, and payments seamlessly

- Stay on top of payroll and remittance obligations

By handing off these tasks to a professional, you reclaim precious hours in your week. That time can now be spent improving customer experience, innovating products, or simply recharging your batteries.

3. Enjoy Clean, Accurate Financial Records

With an accountant, you can get the following:

- Your bookkeeping is timely and precise, with every transaction properly logged.

- Bank accounts and credit card statements are reconciled, ensuring no discrepancies slip through.

- Financial statements like income reports and balance sheets are consistently prepared, aligning with legal and strategic needs.

You’ll always know exactly where your business stands, making audits, loan applications, and growth planning far easier.

4. Plan Taxes Smartly and Stay Compliant

Navigating taxes in Canada can be complex, especially as a small business grows. Accountants are adept at minimizing your tax liability while ensuring full compliance with federal and provincial regulations.

- Identify eligible deductions and credits that most entrepreneurs miss.

- Organize and submit filings on time, avoiding late penalties.

- Understand your obligations across GST/HST, payroll, and corporate income taxes.

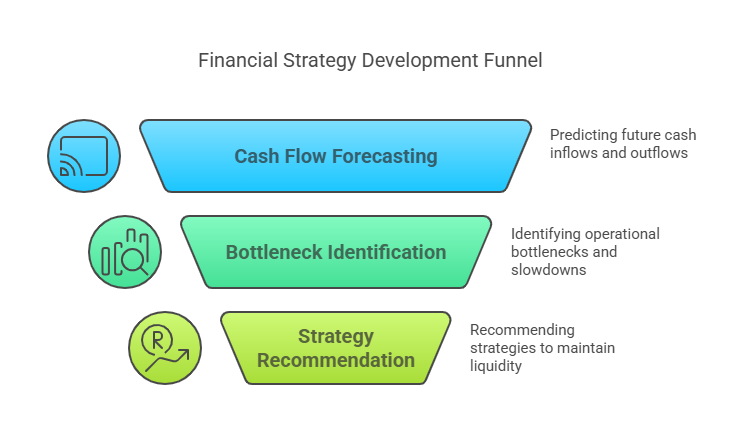

5. Improve Your Cash Flow Management

- Forecasting future cash inflows and outflows

- Identifying bottlenecks or seasonal slowdowns

- Recommending strategies to maintain liquidity, such as negotiating payment terms or securing lines of credit

6. Make Strategic Business Plans with Confidence

Whether you’re considering a new product, an office expansion, or entering a new market, strategic financial planning is critical. Accountants for small business go beyond numbers, they help you turn your goals into actionable financial strategies.

They support you by providing expert financial insights and structure to your plans, including:

- Building tailored budgets aligned with your business model

- Developing realistic financial projections

- Setting and tracking KPIs to measure growth

7. Handle Audits and Reviews with Ease

Even the thought of an audit can be stressful. But when your records are maintained accurately and professionally, audits become manageable and even smooth.

- Ensure your documentation is audit-ready year-round

- Communicate directly with auditors on your behalf

- Resolve discrepancies and implement corrections before they escalate

8. Choose the Right Business Structure and Scale Up

The structure you choose, sole proprietorship, partnership, or corporation has lasting implications for taxes, liability, and scalability. Accountants for small business help you navigate these options with clarity.

They guide you when making critical structural decisions that impact long-term growth, such as:

- You’re launching and need the optimal structure for liability and taxes

- Your business is growing and you’re considering incorporation

- You’re bringing on investors or partners who require transparency

Take a look at this real conversation from Reddit, where small business owners weigh in on the question: “Is accounting worth it for a small business?”

Accountants’ insight ensures your structure adapts to your evolving business needs.

9. Tap Into Helpful Financial Networks

Accountants for small business often serve as connectors in the business world. Their network becomes your resource hub, giving you access to professionals and services that complement your growth.

- Bankers for loans or lines of credit

- Lawyers for contracts or incorporations

- Consultants for marketing, HR, or tech needs

With the right support network in place, it’s time to put your data to work.

10. Make Smarter Decisions Based on Real Data

- Analyze your profit margins per product or service

- Spot unnecessary or rising expenses

- Predict future revenue and identify areas for investment

Conclusion

Hiring an accountant is one of the most strategic moves a small business can make. Far from being a simple number-cruncher, a good accountant is a financial ally helping you stay compliant, reduce stress, make smarter choices, and plan for success.

At One Accounting, we specialize in working with small businesses across Toronto and beyond. From personalized tax strategies to cutting-edge financial insights, our team is committed to helping you thrive.

Ready to simplify your finances and grow with confidence?

Let’s connect. One Accounting is here to guide you every step of the way.

Frequently Asked Questions

Software is helpful, but it can’t replace expert advice or handle complex tax planning and audits.

Ideally year-round. Continuous support means better financial management and fewer surprises.

Yes. They can prepare financial statements and projections required by lenders.

They should be proactive, responsive, and explain things in simple terms. You should feel supported, not confused.

Absolutely. Many offer full payroll services or assist in setting up automated systems.

Yes, accounting fees are usually a business expense and can be deducted from your tax return.